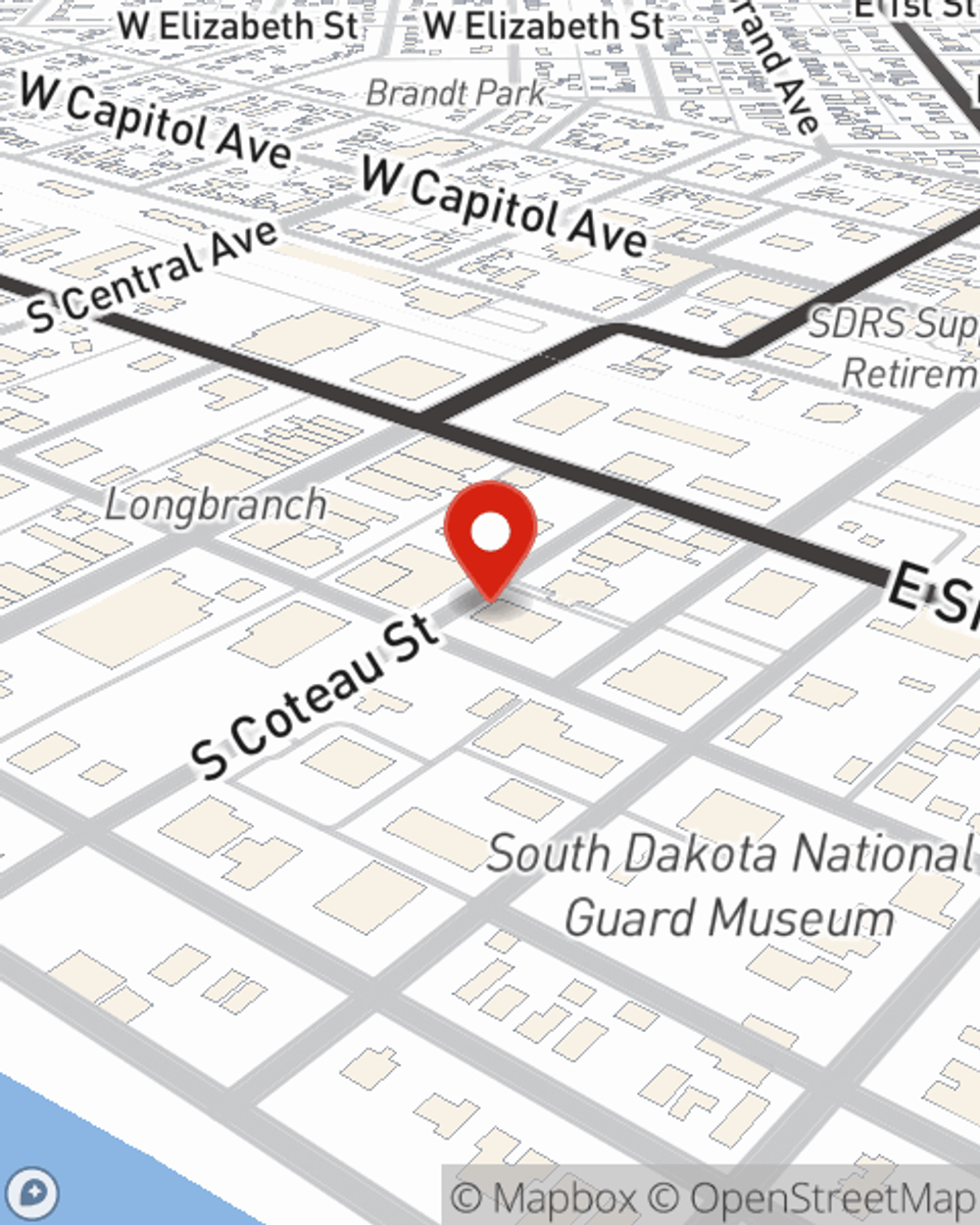

Business Insurance in and around Pierre

Pierre! Look no further for small business insurance.

Cover all the bases for your small business

- Pierre

- Fort Pierre

- Onida

- Blunt

- Harrold

- Highmore

- Miller

- Gettysburg

- Presho

- Winner

- Platte

- Chamberlain

- Murdo

- Hughes

- Stanley

- Sully

- Hyde

- Hand

State Farm Understands Small Businesses.

Small business owners like you have a lot of responsibility. From inventory manager to social media manager, you do everything you can each day to make your business a success. Are you a podiatrist, a fence contractor or a sporting goods store? Do you own an interpreter, a pottery shop or an antique store? Whatever you do, State Farm may have small business insurance to cover it.

Pierre! Look no further for small business insurance.

Cover all the bases for your small business

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, surety and fidelity bonds or builders risk insurance.

As a small business owner as well, agent Kari Bauman understands that there is a lot on your plate. Get in touch with Kari Bauman today to talk over your options.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Kari Bauman

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.